As we see the beginning of the 2022 Fifa World Cup on Sunday, 20th November, many football fans across the globe will be tuning in to support their team and some placing bets.

Gambling and sports have long been intertwined, with half of Premier League clubs having a gambling sponsor. It is also not uncommon to see these gambling companies also buy advertising space within the sporting grounds, magazines or on TV during sporting events. With gambling having such a strong presence within sport, it is no surprise that research from GambleAware has found that 43% of football fans plan to bet during this year’s World Cup.

Betting during the World Cup

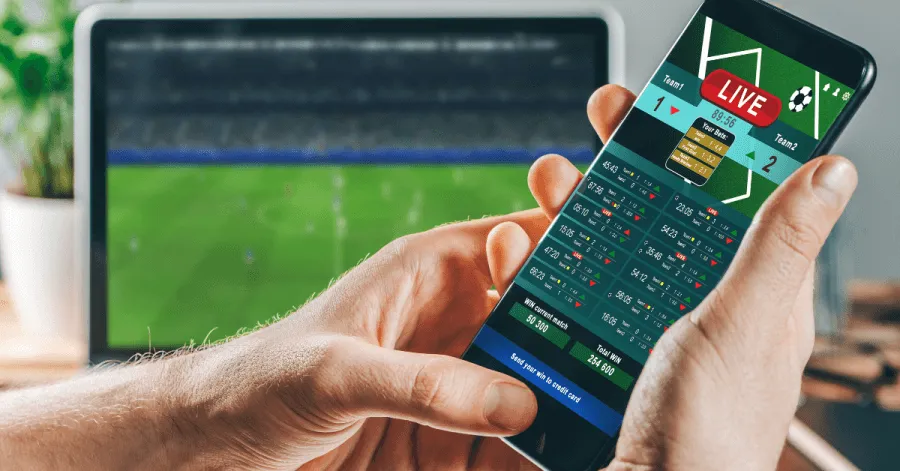

With gambling and sport almost joined at the hip, it is no surprise that the number of bets placed increases during a large sporting event, as those who may not gamble normally get involved. The World Cup is one of the largest events in the football calendar and with 90% of all wagers in the UK going on football, the number of fans placing bets this winter-time is set to sky-rocket.

In addition, 45% of respondents to the GambleAware survey also admitted that they would spend more if they ‘got carried away in the moment’.

This is also the first World Cup to be held during the Winter months, which in itself is causing worry for gambling charities. Malcolm Clarke (FSA Chair) has suggested that the poor weather will deter football fans from watching the games in their local pubs or beer gardens.

Instead, watching it at home is likely to increase the chance of placing a bet as the temptation from apps rises. This is especially true as in-app offers increase the likelihood of gambling by 48% and notifications by 39%.

Gambling and the cost of living crisis

Since late 2021, the UK has experienced a cost of living crisis with the price of energy bills, fuel, food and other essentials increasing. We spoke recently in our Addiction Awareness blog about the emerging link between gambling and the cost of living crisis, with 12% of women surveyed admitting to trying gambling to increase their income.

This is especially true during the run up to Christmas. Christmas time has long been known as one of the most expensive holidays in the year, with the average UK household spending an extra £740, 29% higher than the average month (Bank of England, 2020).

In response to the increased financial pressures felt at Christmas, 39% of survey participants said the rising cost of living would increase their likelihood of betting in the World Cup, in the hopes of supplementing their income.

The dangers of gambling

It is no secret that gambling can become extremely addictive.

A gambling addiction can have a serious impact on mental health, relationships and financial stability. It can create a vicious cycle which can be difficult to break as people gamble to help pay off debts, or gambing addiction lands people in debt.

38.7% of online betters spend between £10-£100 a month on wagers, with 20.9% revealing they have ‘lost hundreds’ due to gambling (Beating Betting).

Although gambling may seem like an escape from reality, the effect on mental health is evident. The Mental Health Foundation has suggested that gambling, and the debts associated with gambling, can lead to ‘low self-esteem, stress, anxiety and depression’.

Getting help with gambling

If you feel you or someone you know is struggling with a gambling addiction, there are a few signs to look out for:

- Spending more than your means to gamble

- Borrowing money to gamble

- Gambling to pay off debts

- Lying to others about money or gambling

There are many gambling charities on hand to help with addictions. These include:

You can also find out more on our Gambling guidance page.

Help with gambling debts

If you are struggling with problem debt due to gambling you can receive free debt advice online. Our debt advice tool can offer the best debt solution for your situation, with no-obligation to sign up. You can access our debt advice tool here, or speak directly to our advisors here.