The original furlough scheme is set to end on 31st October 2020, but what is JSS and what can you expect from it?

The Job Support Scheme (JSS) – which will start as of 1st of November 2020 – has been introduced by the government to replace the original furlough scheme and it will last until 30th April 2021. It is a scheme designed to help employers keep hold of their staff, both part-time and full-time, whilst their business is still being affected by the pandemic.

The scheme is broken down into two parts: JSS Open, which focuses on businesses that remain open but have experienced reduced demand, and JSS Closed, which relates to businesses that have been legally forced to close due to local coronavirus-related restrictions.

JSS Open

JSS Open

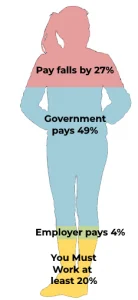

Restrictions imposed by the new three-tier system have caused some businesses to become less busy, but they have continued to remain open. The JSS Open scheme will provide financial help for these struggling businesses as well as their employees, however, there will be responsibilities for the employer and employee.

Employees will have to work 20% of their normal hours which will be paid at the usual rate. Employees will then receive two-thirds of their normal pay for hours not worked; this will be paid in part by your employer and by the government.

JSS Closed

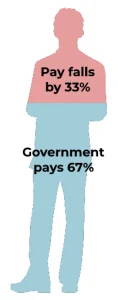

For businesses that are legally required to close, workers will be paid 67% of their wages – up to a maximum of £2,083 per month – which will be subsidised entirely by the government through the Job Support Scheme. Employers do not have to ‘top up’ the 67%, however, they can choose to do this at their own discretion. Ultimately, this could result in a 33% reduction in wages.

Whilst this significant loss may seem daunting if you work for a business that has legally closed, you can also apply for Universal Credit – an additional benefit from the government – but this will depend on your household income, any existing savings you may have, and whether you have children. You can check to see if you can claim here.

Will I be eligible for JSS?

There are similarities to the original furlough scheme, however, you and your employer must meet certain criteria in order to be successfully enrolled in the Job Support Scheme.

- You must have been on your employer’s payroll on or before 23rd September 2020

- You can be on any type of contract, including zero hour and temporary contracts

- You can still qualify even if you were never enrolled in the original furlough scheme

- Unfortunately, you will not be eligible if your place of work is required to close by local public health authorities due to an outbreak of COVID19

- Businesses with less than 250 employees will be eligible for the scheme, however, firms with more than 250 employees will be subject to a Financial Impact Test where they will have to show that their sales have been impacted significantly

I’m self-employed, what help can I get?

The government has also announced an extension to their Self-Employment Income Support Scheme which will work in a similar way to the previous scheme. There will be two grants available: one to cover the period from the start of November until the end of January and the second to cover the start of February until the end of April. There are two important distinctions with the previous scheme:

- The third grant will only cover 40% of trading profits (capped at £3,750) rather than the 80% offered for the first two grants

- You will need to declare that your business has been affected by reduced demand because of coronavirus rather than being “adversely affected”

Unfortunately, there has been no confirmation on when you can apply or when you will receive the third grant, however, you can find any updates through the government website www.gov.uk.

My situation will probably not improve…

My situation will probably not improve…

… so act now! Despite the JSS scheme, a significant amount of people in the UK will be left feeling worried about their financial situation with seemingly nowhere to turn. The Office for Budget Responsibility suggests that, by March 2021, unemployment could reach 13.2%. The reality is that the pandemic is still affecting us and will likely be causing stress and concern well into the new year, so look for advice and support before your situation worsens.

Could a short-term financial solution be a suitable option for you? You may only need help with your debts until your situation stabilises; if that’s the case, a Debt Management Plan may be a viable option. Find out what a Debt Management Plan can do for you here and then start your application here.

If you feel you may need a more long-term solution, visit our Online Debt Advice tool on our website or contact us on 01925 599400.